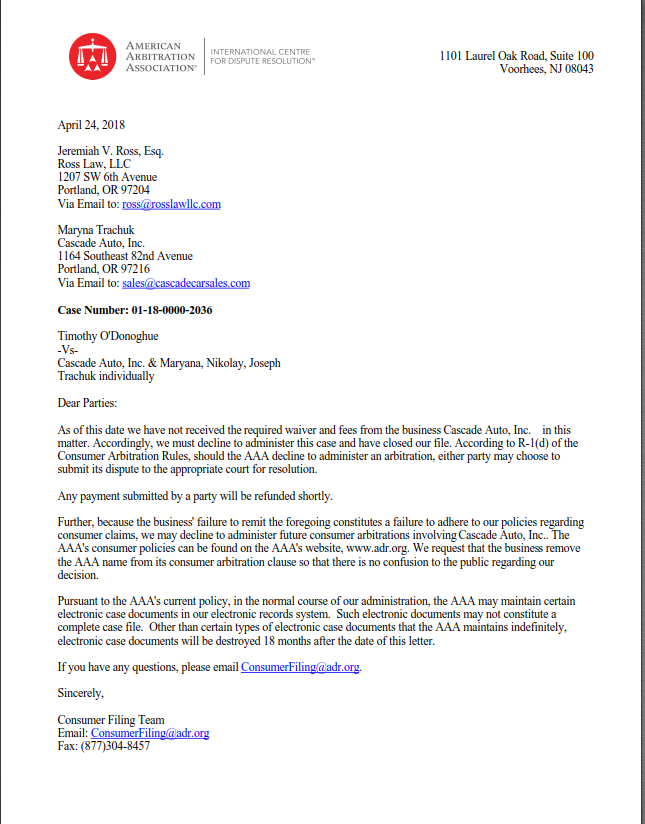

8) You Can Cross Things Out and Refuse to Sign Certain Documents: We live in a world of pre-printed forms. Many times people sign things without reading them. If you reviewed the documents then you will see language that you don't understand or you don't want to agree to. This is where you can use your phone to look up any terms you don't understand, and you can cross out the conditions and terms you don't want to agree to. For example, you should ALWAYS cross out any language saying you are agreeing to binding arbitration and/or forfeiting your right to a Jury trial. This is often buried in the "fine print," but you should always cross it out or refuse to sign any clause or stand-alone document that is forcing you into arbitration. Click here to find out why Arbitration is bad for Oregon consumers.

9) Negative Equity in Your Trade-In WIll Make Your Payments Much Higher: Assume you did your homework on vehicle price, you refused the add-ons, and are sticking to your bottom line and you have a trade-in that is worth less than the amount you owe on it. Dealers have a difficult time rolling in negative equity into a new loan because many finance companies are leery of extending credit to folks in this situation. This is due to the fact that the collateral on the loan for the new vehicle won't cover the full cost of the loan in the event of a default. However, dealers are crafty and can usually get financing if needed. They may get a co-signer, fudge numbers, claiming non-existent down payments, or other schemes to get the negative equity rolled into the new loan. If the negative equity is rolled into the new loan then most likely your payments are going to be MUCH higher than you anticipated. I get calls from many people that get home and review their paperwork only to find out that they have agreed to a $400.00 car payment when they thought they were only agreeing to a $250.00 car payment. Many times the reason for this is the consumer agreed to roll in the negative equity into the new loan.

10) There is No Automatic Right to Return a Vehicle In Oregon: There is a myth that many consumers propagate that if you buy a car you automatically have [insert number here] number of days to return a vehicle. I have heard people say it is 3 days, 7 days, 14 days, 30 days, and 60 days. Under Oregon law, there is no automatic right to return a vehicle that you purchased at a dealership. However, your contract or agreement with the dealer may allow you to do so.

11) The Dealer May Have 14 Days to Complete Financing for the Vehicle: Many people drive off of the lot in their new or used vehicle and then get a call from the dealer a week later. The dealer says financing fell through so they need to come back and agree to new financing terms. Usually, the dealer wants more money for the down payment or may want to increase the interest rate. This is called a Yo-Yo Scam or a bushing scam. This is legal, but only if, the dealer follows the law to the letter. This includes, but is not limited to, telling you that you have the right to immediately receive your trade-in back and/or your downpayment back. At the dealership, the dealer should have the trade-in ready for you to pick up and your downpayment ready for you to get if you do not agree to the new financing terms. Click here for more information on Yo-Yo Scams. If you review the documents (see above) you will know exactly what the dealer is doing and prevent the dealer from sneaking in new additional terms.

12) If It Isn't In Writing It Doesn't Count: Dealers make a lot of promises. Many dealers will tell a consumer that they will fix something on the car, or make an oral agreement about when the downpayment is actually due. These agreements typically are not binding, because the Purchase Agreement or the Retail Installment Contract has a clause that says that those documents contain the entire agreement. The bottom line is if the dealer promises something then get it in writing. If they refuse, then walk out.